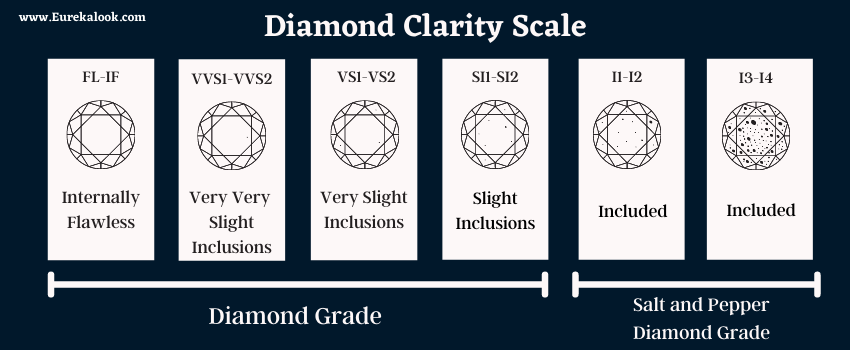

Choosing an engagement ring can be overwhelming - you have to critique the 4 Cs of every ring you examine: cut, clarity, color, and karat size. But there is a fifth "C" to consider: the cover.

While engagement ring insurance is not part of the tendency testing process, it is a key product that makes sense to many buyers. How beneficial is insuring your jewelry and is it really worth buying?

No one wants to worry about what might affect their happiness at a time like this, but you should really consider insuring your engagement ring.

What if you lost your ring? What if someone steals it? If it is damaged? You don't want anything to happen to this beloved rock. Whether you accidentally forgot your engagement ring at the beach, lost a stone at the gym, or your ring was stolen, ring insurance offers financial protection and security when you need it most. "If you mind that your ring is lost, broken, or stolen, it is valuable enough to be insured."

“If you think you are pillaged by a sentimental loss, are worried about wearing other jewelry without insurance, or cannot cover the cost of replacing the item, it is wise to make sure your engagement or wedding ring is covered by an assurance."

Engagement ring insurance is a contractual risk management tool that protects you from the financial consequences in the event of loss, theft, or damage. "If you mind that your ring is lost, broken, or stolen, it is valuable enough to be insured."

Who needs ring insurance?

You might be wondering if it's worth the cost of insuring your ring. Do you really need engagement ring insurance? Here are some signs that it might be a good idea:

You want to replace your engagement or wedding ring if it is lost, damaged, or stolen.

You are more likely to damage or lose a ring. For example, a coworker may be in a job that may be difficult for the rings or perhaps a little above average forgetful.

Replacing the ring would cost over $ 1,500. If this is the case, the ring is unlikely to be fully covered by insurance for existing tenants or owners. Without additional insurance, you would expect a higher cost to replace or repair a ring.

Are alliances covered by home insurance?

The short answer is yes, jewelry is included in homeowners 'and renters' insurance policies that cover the value of items in your home. However, jewelry coverage is only up to a certain dollar limit and there may be group limits; H. a limit on the total value of all items. Circumstances such as loss or damage should not be taken into account. And in most cases, there is a deductible on the coverage before you receive a refund.

Here are five reasons why you should purchase this insurance, both for your financial well-being and for your peace of mind.

- Possible loss or theft

- Protection against damage

- Travel insurance

- Profitability

- Peace of mind

You have several options when considering insurance for your ring:

- Renters 'and Homeowners' Insurance:-

These policies can cover the loss of your ring up to a certain amount, subject to your policy deductible and specified limits for unscheduled personal property. Full coverage for big-ticket items, such as jewelry, can be obtained by purchasing scheduled personal property insurance, an extension that covers specifically listed items. Ask your insurance company or agent about this coverage for your engagement ring.

- Jewelry Insurance: –

Another option is to insure your engagement ring with a company that specializes in jewelry insurance. These companies may offer more comprehensive coverage than a standard home insurance policy. For example, you can use these guidelines to recover a lost part or repair a damaged part. The engagement ring is one of the most important purchases of your life - honor it by protecting it.

Coverage differences

Each insurance company is different and the items covered by your jewelry insurance policy may vary.

You need to find a policy that covers all eventualities, which means you're protected if your ring is stolen, slips out of your hand while gardening or the gravestone comes loose and falls.

Some insurers impose a deductible on engagement ring coverage, while others protect it without having to pay anything out of pocket. Consider the applicable deductibles before purchasing your policy.

You should also make sure that you are happy with the jewelry replacement options available in case you ever need to make a claim. Some insurers will provide you with a reasonable replacement through the jeweler or company of your choice, while others will give you a say in choosing your new diamond and/or ring.

Considering the high average cost of alliances, purchasing insurance is a smart move. If your jewelry is sufficiently covered by your current tenant's modest personal property allowance or home insurance, that's okay. But if not, how and where you choose to secure your alliances will largely depend on your specific needs and assessments. By carefully examining the fine print of potential policies and comparing the actual costs and coverage, you can ensure that you have adequate protection for the jewelry of monetary and emotional value.

As with anything you love, you can Safe your engagement ring so that your bride-to-be can wear it with confidence and pride and enjoy her beauty without worrying about damage or loss. Nominal insurance costs can keep you calm for years to come.

Sale

Sale